Data Differential May Surprise You!

Not all data is created equal...

Lets begin by doing some comparisons:

I have pinpointed an exact moment where the Data Differential between KuCoin and Binance that becomes apparent. You will notice that each signal was sent within the same minute containing the exact same targets. When calculating target percentages and Data Differential you must consider many possibilities. I often find myself asking a multitude of questions... What is the likely target for this signal? How strongly do I feel the full target will be achieved? Where are the most likely points of resistance on the way to the target? How far apart are they? What does the historical data say?

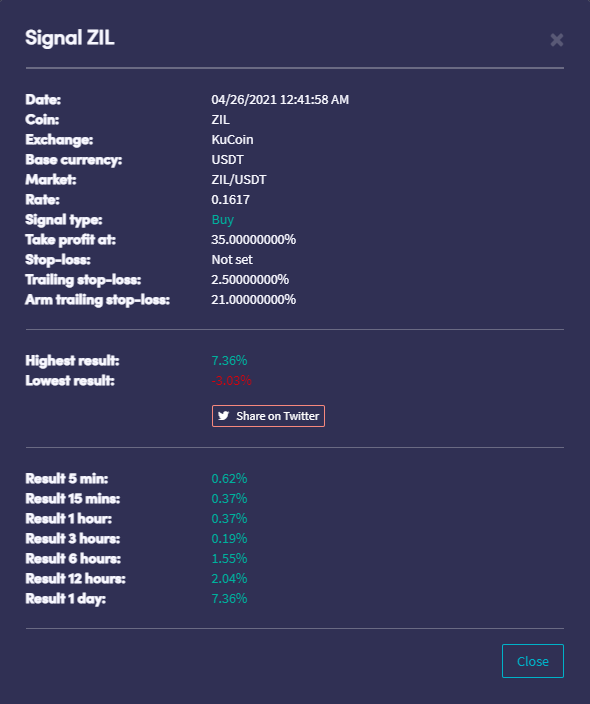

The 2 image's below can be found on Killer Whale Premium Signals in the Cryptohopper Marketplace when you navigate to performance reports and click view on the last placed positions for ZIL/USDT on 04/26/2021.

Lets take a closer look at the results according to timeframes after the launch of each signal. Starting with the image above for KuCoin you will notice that the results on shorter timeframes from 5min to 12hours are actually lower percentages on KuCoin.... However once you reach the 1day mark KuCoin is clearly regaining the momentum. Eventually finishing more than 11% higher than the same signal sent through Binance because of Data Differential. It is simply because when measuring certain timeframes we expect to experience reaching for a large target such as 35%. These trades often take days or weeks to finish with little noticeable difference. Yet we find the Data Differential apparent when our position finishes in just over 1 day.... Interesting.

How about the very next trade that finished?

This trade is for XTZ/USDT on KuCoin:

The Image below is a signal for XTZ/USDT on Binance launched within 1 minute of the previous with the exact same metrics:

Friends let me also remind you that Data Differential does not happen all of the time. Here is a series of trades for AAVE/USDT that finished with identical profit percentages both on KuCoin and Binance on 04/15/21:

While Data Differential does not occur all or even half of the time it is too great of a metric to ignore when bot and algorithm trading. It is far too important for us to ignore as a traders and technical analysts. There is one constant that persists over and over again which is very small discrepancies between exchanges known as arbitrage. I will now highlight this in the price action of the ZIL/USDT on the 4hr chart for KuCoin and Binance.

This is a measurement of the price action on a KuCoin 4hr chart that lead to the 30.24% ZIL/USDT trade discussed above:

This is the measurement of the price action on a Binance 4hr chart that lead to the 19.04% ZIL/USDT trade discussed above:

Is there a noticeable Data Differential?

Well look at that... once again we are able to discern indeed there a difference of 2.26%. Therefore KuCoin was able to reach higher targets by a Data Differential of 5D/2.26% in this instance. Here is the mind-blowing part, we would never have been able to predict this in advance. All we can do now is observe, learn and continue to speculate. As always stay strong and be safe friends!

Killer Whale Crypto

P.S. Use this > KuCoin link to have the best data in the crypto space!

Most Recent

Killer Whale Portfolio Management Service

Ashley E. Shiver - Apr 9, 2024

Redefine Wealth: Exploring Crypto's New Frontier in Generating Profit

Ashley E. Shiver - Apr 8, 2024

Cryptocurrency: The Unsung Hero of Global Unity

Ashley E. Shiver - Feb 29, 2024

The Epic Saga of Blockchain Evolution

Ashley E. Shiver - Feb 27, 2024

Smart Contracts: Automating the Future

Ashley E. Shiver - Feb 26, 2024

7 Reasons Crypto is Skyrocketing in 2024

Ashley E. Shiver - Feb 25, 2024

Stay Up To Date

Get weekly insights and updates from the Killer Whale Crew

Categories

Start Trading

Large Cap

strategy

Trade Duration

Trade Frequency

Gain ETH

strategy

Trade Duration

Trade Frequency

Gain BTC

strategy

Trade Duration

Trade Frequency

Pro

strategy

Trade Duration

Trade Frequency